- Pulses stocks in warehouses located in major ports and in pulses industry hubs should be verified

- Strict action to be taken on stockholding entities found to be reporting false information on stock disclosure portal

- The Centre directed all States and UTs to enforce weekly stock disclosure of pulses by all stockholding entities and verify the stocks declared by them. Stocks in warehouses located in major ports and in pulses industry hubs should be verified from time to time and strict action should be taken on stockholding entities found to be reporting false information on stock disclosure portal.

- Apart from the five major pulses, namely, Tur, Urad, Chana, Masur and Moong, the States/UTs have been asked to monitor the stock position in respect of imported Yellow Peas. The import of Yellow Peas has been allowed from 8th December, 2023 for a period till 30th June, 2024 to augment overall availability of pulses. Smt. Khare stressed the need to ensure that imported Yellow Peas are continuously released in the market. Similarly, stocks of Tur, Urad and Masur with importers are to be monitored for smooth and continuous release in the market.

Source:Department of Consumer Affairs

- India is expected to have a ‘normal’ monsoon between June and September 2024, with monsoon rains predicted to be 102% of the long-period average.

- Different regions of India will experience varying levels of rainfall, with above-normal rains expected in central and western parts, normal rains in northern and southern parts, and below-normal rains in North-east India and Eastern parts.

- The transition from El Nino to La Nina is anticipated to impact the onset of the monsoon season, with uneven rainfall distribution throughout the season.

- The South, West, and Northwest regions of India are predicted to receive favorable rainfall, while eastern states like Bihar, Jharkhand, Odisha, and West Bengal may face the risk of deficit rainfall during peak monsoon months.

- According to the report, the monsoon probabilities for June to September indicate a 10 per cent chance of excess rainfall, a 45 per cent chance of normal rainfall, with a 20 per cent chance of both above-normal, 15 per cent chance of below-normal rainfall, and a 10 per cent chance of drought conditions.

Source:Skymet

- Due to an increase in production in Maharashtra and Karnataka, the sugar trade association AISTA revised the nation’s sugar production upward by 4,00,000 tons to 32 million tonne for the 2023–24 season (October–September).

- The availability of sugar in the country is anticipated to be 37.7 million tonne, which is higher than the predicted domestic demand of 29 million tonne, given an estimated 32 million tonne of sugar output and an opening stock of 5.7 million tonne. In the previous 2022-23 season, sugar production was 32.9 million tonne.

- According to the All India Sugar Trade Association (AISTA) Chairman Praful Vithalani, the crop committee has revised sugar production estimates marginally from 31.6 million tonne to 32 million tonne for the 2023-24 season. Sugar production in Maharashtra is estimated to increase by 1.2 million tonne but decrease by almost the same 1.1 million tonne quantity in Uttar Pradesh.

- Similarly, the estimated decline of 3 million tonne in Tamil Nadu is likely to be compensated by a gain of 0.4 million tonne in Karnataka, he said. In the remaining states, the production estimates are almost the same as the first estimates.

- As per the second estimate, sugar production in Maharashtra, the country’s largest sugar producing state, is estimated to increase marginally to 10.8 million tonne for 2023-24 season, as against 10.7 million tonne in the previous season. However, sugar production in Uttar Pradesh — the country’s second largest producing state — is estimated to decline slightly to 10.6 million tonne from 10.7 million tonne last season.

- Similarly in the country’s third largest sugar producing state of Karnataka, the production has been revised upward but still remains lower at 5.1 million tonne in 2023-24, as against 5.6 million tonne in the previous season.

- According to AISTA, India has 2-2.5 million tonne of additional closing stock than required. Here, two windows get open to allow exports of sugar or ethanol blending for 2024-2025 season.

- The closing stock of sugar would be around 8.6 million tonnes in the 2023-24 season.

Source:cnbctv18

- With a healthy closing stock before the conclusion of the season, the Indian Sugar Mills Association (ISMA) has asked the government to permit the export of 10 lakh tonnes of sugar during the current 2023–24 season.

- Sugar production has reached 302.20 lakh tonne till March of the current season against 300.77 lakh tonne in the year-ago period, it said in a statement.

- The sugar season runs from October to September. Currently, there are curbs on the export of sugar from the country.

- In mid-March, ISMA revised its net sugar production estimate for the 2023-24 season to 320 lakh tonne.

- The request for export suggests a careful balance between meeting domestic consumption needs, sustaining the Ethanol Blending Program (EBP) and leveraging surplus for export opportunities, it added.

- The industry body said weather forecasting agencies have predicted a normal to above-normal South West monsoon for the year 2024. Consequently, a moderate crushing season is expected in the 2024-25 season.

Source: Business standard

- In an announcement on March 26, the food ministry allocated a monthly sugar quota of 25 lakh metric tonnes (LMT) for April 2024, which is 3 LMT higher than the quantity allocated in April 2023 (22 LMT).

- In March 2024, the allocated sugar quota for domestic sale was 23.5 LMT.

- According to market experts, as the Lok Sabha poll is around the corner, therefore a higher quota of 3 LMT was given compared to April 2023.

- This is likely to put pressure on the domestic market, and prices are expected to fall by 30 to 40 Rs per quintal.

Source:chinimandi

Due to Food Corporation of India (FCI)’s active sale of grains on the open market during this fiscal year and minimal procurement over the previous two years, wheat inventories in the central pool dropped to a 16-year low of 7.73 million tonne (MT). The stockpiles are probably going to be dangerously near to the 7.46 MT buffer for April 1st, sources informed FE. It was far back in 2008 when wheat stockpiles fell below their current levels. In April of the same year, it had then fallen to 5.8 MT. The purchase by the government agencies under the minimum support price (MSP) operations decreased to a record low of 18.8 MT in the 2022–23 season, following a record procurement of 43.3 MT in the 2021–22 season (April–June). In the rabi marketing season of 2023–24, it did, however, increase by over 40% to 26.2 MT. The government agencies have reduced their purchases under MSP operations during the previous two seasons as a result of lower supply and strong local demand driving prices over MSP, an official stated. In an effort to lower retail costs, the government discontinued the open market sale of wheat earlier this month. The sale had been conducted through weekly e-auctions since June of last year, with a record-breaking 9.4 MT of wheat sold to bulk purchasers.

(Source-Financial Express)

An intense ‘western disturbance’ — a wave of moist winds from the Mediterranean region that impacts north India — impacted the region from Feb 29 to March 4, causing hail and thunderstorms in the plains and heavy snowfall in higher Himalayas. The primary producing regions of India have seen unseasonal rains and hailstorms, damaging winter-planted crops including wheat, rapeseed, and chickpeas, which has caused harvesting to be delayed, industry and government sources told. State revenue agencies in Punjab, Haryana, Madhya Pradesh, Uttar Pradesh are now evaluating the degree of damage over wheat, the primary winter grain, was severely damaged in some areas, according to authorities. Unfavorable weather might restrict wheat output growth and make it more difficult for the government to increase stockpiles. In its second advance estimates released last week, the agricultural ministry predicted that wheat output would increase 1.3% to a record 112 million tons. However, fear has started that this figure may potentially be lower if significant crop damage was.

Punjab: Crop losses were reported in 2% to 5% of the cultivable land of Punjab, according to initial estimates. “Crop damage, predominantly wheat and mustard, is distributed across 1.5 lakh hectares (370,658 acres),” stated Jaswant Singh, head of Punjab’s department of agriculture and farmer welfare.

Uttar Pradesh: Crop damage reports came in from all over the Uttar Pradesh. Mahoba and Lalitpur districts recorded losses of more than 40% to standing crops, and other locations in Amethi, Etah, Ghazipur, Gorakhpur, Hardoi, Kaushambi, and Meerut allegedly suffered damage to a third of the crops. When the hailstorm arrived, the wheat and mustard were both at the milking stage. A farmer from Bijnor’s Chandak hamlet named Rajinder Singh stated, “There’s a permanent loss of 15%.” The standing sugarcane crop has sustained significant damage, according to Shamli’s Dharmender Malik.

Haryana: In the districts of Ambala and Kurukshetra, the recent unseasonal rains and hailstorm have impacted the wheat crop on around 70,700 acres and the oilseed crop on approximately 3,720 acres. According to the information obtained, Kurukshetra’s crops on about 63,807 acres—62,200 acres of wheat and 1,607 acres of mustard—have been impacted. Of the total wheat impacted area, 49,300 acres had a crop affected by 0–25%, 12,400 acres had a crop affected by 26–50%, and 500 acres had a crop affected by 51–75%. Comparably, in the case of the mustard crop, 1,315 acres had 0–25% crop damage, 280 acres had 26–50% crop damage, and 12 acres in Kurukshetra had 51–75% crop damage.The site for e-Kshatipurti has opened, and the farmers should get their losses registered there by March 10.

Madhya Pradesh: Thousands more have also been affected by the unexpected calamity in more than 20 districts, including Shivpuri, Tikamgarh, Datia, Chhattarpur, and Guna districts.The storm has destroyed standing crops in the Tikamgarh area of Madhya Pradesh, including mustard, wheat, gram, and lentils. The crops suffered damage in over six villages, including Bamhorikala, Jewar, Uprara, and Lidhaura. Farmers report that the hailstorm that began on Friday damaged 50% of their crops. In Tikamgarh, 1,92,000 thousand hectares are used for wheat cultivation, while 22,900 hectares are used for mustard planting. It is reported by farmers that there is a loss of 25% in mustard and 10% in wheat.

According to a trader with a worldwide trading business located in New Delhi, damage has been observed in all wheat-producing regions, from northeastern Punjab and Haryana to central India’s Madhya Pradesh. This will undoubtedly have an impact on wheat output.

The India Meteorological Department (IMD) stated in a statement on Sunday that two western disturbances are anticipated to bring showers, thunderstorms, and gusty winds to the plains and snowfall to the higher elevations of the Himalayas this week. Though the wheat crop is ready for harvest in a few weeks, experts are concerned about lodging. Jammu & Kashmir, Ladakh, Gilgit, Baltistan, Muzaffarabad, Himachal Pradesh, and Uttarakhand are expected to get mild to moderate rainfall and snowfall from March 10–12. This is due to the current western disturbance. On March 13, there would be gusty wind and rains across Punjab, Haryana, Delhi, western Uttar Pradesh, and north Rajasthan. on the same day, there will be another mild western disturbance that will bring snowfall and strong gusts to northwest India. Thunderstorms and lightning are likely over Jammu and Kashmir, Ladakh, Gilgit, Baltistan and Muzaffarabad on March 13, and over Himachal Pradesh and Uttarakhand on March 13-14, IMD said.”The wheat crops in Punjab, Haryana, and Rajasthan will be affected if there is crop lodging due to gusty winds,” stated Bhudeva Singh Tyagi, principal scientist at the Indian Institute of Wheat and Barley Research. “In dry regions, wheat, gram, and mustard crops would be primarily impacted by hailstorms and unseasonal rain. “Traders in Rajasthan are concerned that unseasonal rains could affect wheat crop quality. Hailstorms and rain last week have caused a delay in crop harvesting. Rain may have an effect on wheat quality, according to CP Gupta of Rajasthan’s Chesta Enterprise.

(Source- www.msn.com)

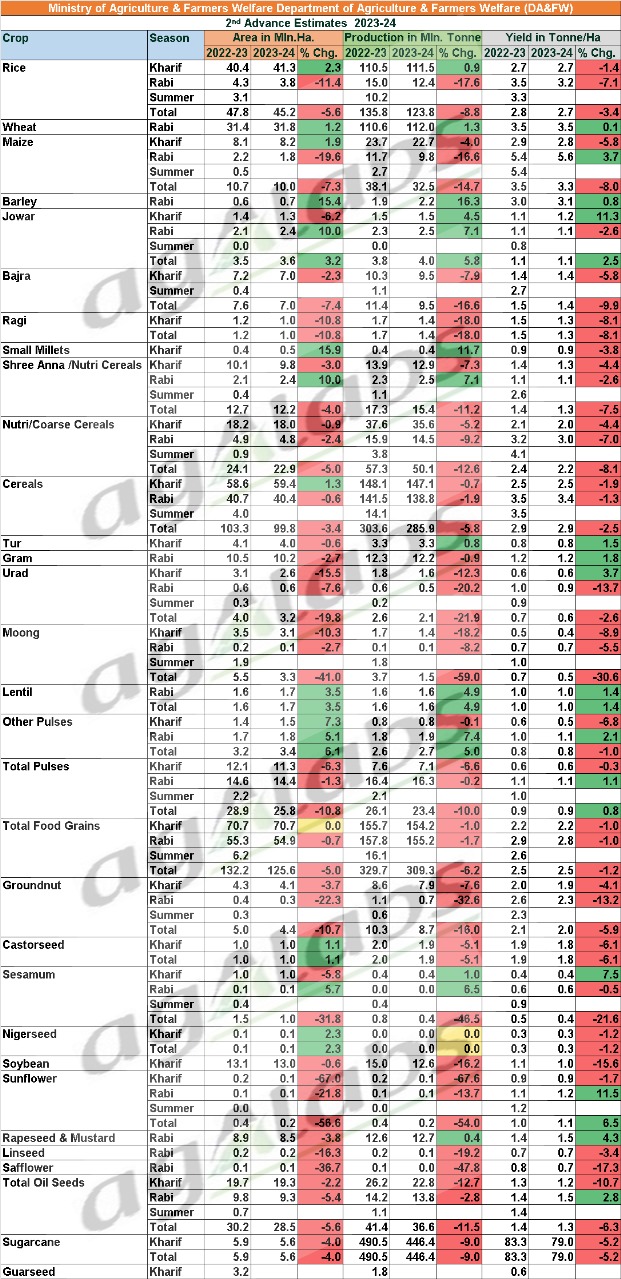

- The Ministry of Agriculture and Farmers Welfare has released Second Advance Estimates of Major Agricultural Crops (Kharif & Rabi Season) for the year 2023-24. From the last agricultural year, the summer season has been segregated from Rabi season and therefore this year Second Advance Estimate of area, production and yield includes only two seasons i.e. Kharif and Rabi season.

- The total sugarcane production is now revised higher at 4,464 LT for 2023-24 from the previous estimate and around 10% lower compared to the previous year cane production.

- While preparing the kharif crop production estimates the Crop Cutting Experiments (CCEs) based yield has been considered. However, States are still under the process of compiling results of Kharif CCEs. Further, CCEs of few crops viz., Tur, Sugarcane, Castor etc. are still ongoing.

Source: PIB

The agricultural ministry announced on Friday that the production of food grains in the 2023–24 crop year (July–June) is predicted to decrease by 6% to 309.34 million tonne (MT), from 329 MT in the previous crop year, due to a decrease in the output of rice and pulses. Because of the inconsistent monsoon rainfall during the previous crop year, rice output is expected to decrease to 123.8 MT from 125 MT in the second advance estimate of foodgrain production.The output of summer crops is not included in this prediction of rice output; this information will be included in the third advance estimate of food grain production, which is scheduled for release in June.The estimate for the production of food grains for the current crop year will be amended later, according to officials, even though the rabi crop harvesting has already begun.An official announcement stated that “these figures are subject to change in the successive estimates upon the receipt of better yield estimates based on crop cutting experiments.” 332 MT was the goal for foodgrain output for the current harvest. The main rab crop, wheat, is expected to yield 112 MT, a little bit more than the previous harvest year.

Source: Financial express

In 2023, Brazil reached a record-high soybean export of 3.74 billion bushels, a 29% increase from the previous year. This surge coincided with Brazil’s record-high level of production. The United States experienced a 14% decline in soybean shipments, reaching 1.78 billion bushels. Both Brazil and the United States are major players in the global soybean market, contributing to over 80% of worldwide soybean exports. Brazil’s soybean exports have surged by 431 percent over the past two decades, highlighting its growing dominance in the market. The United States has experienced a more gradual increase in soybean exports, but has stabilized since 2016, exporting around 49% of its soybean production. Brazil’s surge in soybean exports is attributed to favorable weather conditions, investments in agricultural infrastructure, and expansion of cultivation areas.

Source:www.chemanalyst.com

India plans to begin wheat procurement on March 1st and aim to acquire 114 lakh metric tons (LMT) of wheat this season. While the administration is still hopeful that problems with the protesting farmers will be resolved before the procurement season, Food Secretary Sanjeev Chopra indicated that more discussions are welcome and hinted that there may not have been clear communication of intentions to the demonstrators. The administration is expecting a record-breaking rabi harvest due to the early arrival of the wheat crop and the lack of an early warm weather forecast. Some states, like Uttar Pradesh, are trying to buy wheat as early as possible. To improve this process, farmer awareness workshops are being held to tell farmers about the available Minimum Support Price (MSP). The Secretary made it clear that allegations of dishonest people stockpiling rice in anticipation of strong export prices once the export prohibition expired—rather than a shortage—were the reason behind the prolongation of tax on parboiled rice. The Secretary noted the government’s encouragement of maize for ethanol production, even if she stated that there is no proposal to alter the limit for diverting sugar syrup for ethanol production. The National Agricultural Cooperative Marketing Federation of India (NAFED) and distilleries are finalizing agreements, and on February 13, a Standard Operating Procedure (SOP) was circulated with the goal of ensuring MSP and building an ecosystem that will support increased maize cultivation, crop diversification, and farmer welfare.

Source: CNBC

Brazil and Argentina are expected to maintain their positions in the global soybean market this year. Although Brazil’s harvest is projected to slightly decrease from last year’s record crop, Argentina is forecasted to double its soybean production. Together with the United States, these countries constitute the primary soybean producers globally, accounting for 80% of the total output. China, in contrast, holds a much smaller share at 5%.

According to estimates from the US Department of Agriculture (USDA), Brazil is poised to harvest approximately 156 million tonne of soybeans this crop year, slightly less than the previous year’s record of 162 million tonne. Brazil’s leading position is further solidified by a 1.3 million-hectare expansion in soy production area, reaching 45.9 million hectares, surpassing the US.

In the US, the soybean harvest concluded by the end of 2023, yielding around 113.3 million tonne, marking a decline of about 2.9 million tonne compared to the previous year.

In Argentina, the third-largest producer globally, the harvest is expected to be notably larger than the previous year, which was hampered by drought and heat. Forecasts suggest the output could even double to 50 million tonne, fueled by higher yields and expanded soy cultivation areas.

Conversely, China is anticipated to increase its harvest volume by approximately 556,000 tonne from the previous year, reaching 20.8 million tonne, as per the latest USDA estimates.

Source: Biofuels International

The Indian government decided on Wednesday to keep the 20% export tax on parboiled rice in effect past March 31. In August of last year, the government levied a 20 percent tariff on the export of parboiled rice with the intention of preserving a sufficient supply locally and controlling domestic prices. Later, it was extended to March 31, 2024. The finance ministry announced in a statement that the 20 percent export tariff will remain in effect after March 31 without a deadline. Additionally, the period for the duty-free import of yellow peas has been extended until March 31 as long as the bill of landing is provided by April 30, 2024, at the latest. The Ministry of Statistics & Programme Implementation issued statistics earlier this month showing that India’s retail inflation fell to 5.10 per cent on an annual basis, down from a four-month high of 5.69 percent in December. Due to rising market supply and government initiatives, the cost of rice has decreased by up to 10% over the previous month, making the basic food grain more accessible to Indian households. Prices for basmati rice have dropped by 10%, whilst non-basmati rice has decreased by up to 7%. Ahead of the general elections, the government should benefit from the price decrease of the most popular grain.

Source: Economic times

The standard operating procedure (SoP) for the government’s plan has been released. According to it, cooperatives like NAFED and NCCF would contract with distillers to guarantee a supply of maize at ₹2,291 per quintal for the production of ethanol.

A Chhindwara, Madhya Pradesh, distiller and NAFED are expected to sign the first agreement under the scheme, which aims to guarantee maize farmers a minimum support price (MSP) and distilleries a continuous supply of feedstock, thereby reducing price volatility for both parties.

The action is a component of the government’s larger attempt to boost gasoline-ethanol blends, which reached 12% in the Ethanol Supply Year (ESY) 2022–2023 and are targeted to reach 15% in the ESY 2023–2024. According to information obtained, as of January 31, the blending rate for the current ethanol year, which started in November 2023, was approximately 12%.

Under the SoP, NAFED and NCCF will enter into a supply contract with distillers for supply of maize with price, quantity, location of supply and other commercial terms and conditions pre-defined for the ESY.

- For ESY 2023–2024, the distiller will pay ₹2,291 per quintal for maize, which includes all procurement prices and agency profits. The current maize MSP, which will be changed later, is ₹2,090 per quintal and will take effect in October 2024.

- The distiller will pay the transportation cost of maize from the mandi to the distiller’s warehouse. If the sale is through the ONDC platform, then the buyer will bear the buyer margins of ONDC.

- To achieve the target of 20 per cent ethanol blending with petrol under the EBP programme by 2025, the focus is on maize, a hardy crop that can withstand drought.

- With production of sugarcane expected to be impacted, the government is focusing more on increasing the use of maize as a feedstock for producing ethanol. To achieve this, the production of the commodity needs to be increased.

Source: TheBusinessline

The country has effectively attained an ethanol blending rate of 11.20% as of February 4, 2024. The current Ethanol Supply Season began on November 1, 2023, and the revised allotment for ethanol deliveries from (Sugar) molasses-based distilleries is 162 crore liters, down from the earlier allocation of 270 crore liters. Distilleries that use molasses have contracts for 123.52 crore liters, while 76.97 crore liters have been supplied to Oil Marketing Companies (OMCs).

Breaking down the feedstock-based ethanol supplies for (Sugar) molasses-based distilleries, the revised allocation for ethanol from B Heavy molasses is now 115 crore liters, down from the initial allocation of 130 crore liters. Although actual supplies of B Heavy molasses reached 34.45 crore liters, total contracts for the product total 73.93 crore liters.

The initial 136 crore liters of Sugarcane Juice (SCJ) allocation has been reduced to 43 crore liters. With 41.17 crore liters of provided ethanol, the total contracts from SCJ equal to 44.7 crore liters. The allocation of ethanol supplies from C Heavy molasses has not been changed; it is still 4 crore liters, with 1.35 crore liters of supplies now on hand.

Turning our attention to ethanol distilleries based on grains, the allotment stays at 292 crore liters, unaltered. Out of this, the contracted quantity is 146.23 crore liters, and the total supplies amount to 45 crore liters. Damaged Foodgrains (DFG) is currently providing 25.66 crore liters of ethanol, as opposed to the 84.92 crore liters that were contracted. With supply from maize reaching 19.34 crore liters as of the first week of February, compared to a total contracted quantity of 45.97 crore liters, the government has offered policy support to increase ethanol production from maize.

In total, the ethanol supplies from both molasses-based and grain-based distilleries amount to 121.97 crore liters, as against to the total contracted amount of 269.75 crore liters.

Source: Chinimandi

La Nina means colder-than-usual temperatures in the Pacific Ocean near the equator and often brings floods and droughts. The National Weather Service’s Climate Prediction Center (CPC) mentioned that although predictions made during spring are not always very accurate, it’s quite common for La Nina to follow strong El Nino events, historically.

According to the CPC’s monthly forecast, the ongoing El Nino weather pattern, responsible for creating hot and dry conditions in Asia and unusually heavy rains in certain parts of the Americas, is expected to transition to ENSO-neutral conditions between April and June 2024.

Sabrin Chowdhury, who oversees commodities at BMI, mentioned that La Nina could impact wheat and corn production in the U.S., as well as soybean and corn production in Latin America, including Brazil.

Meteorologists and agricultural analysts suggest that following a strong El Nino, global weather is likely to switch to La Nina in the latter part of 2024. This pattern usually brings more rain to Australia, Southeast Asia, and India.

India, being the largest rice provider globally, limited rice exports due to a weak monsoon, whereas Australia, the second-largest exporter of wheat, faced a decline in wheat production. Additionally, palm oil plantations and rice fields in Southeast Asia experienced below-average rainfall.

According to an official from the India Meteorological Department, the emergence of La Nina tends to be advantageous for the Indian monsoon. Typically, during La Nina years, the monsoon brings plentiful rainfall.

Source: Reuters

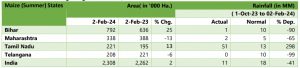

According to Department of Agriculture & Farmers Welfare, the area under Summer maize is increased by 2 percent to 2,308 thousand hectares as against 2,262 thousand hectares sowed during the same period last year.

Bihar, stands out among the Indian states as the one that contributes the most to the sowing of maize, with 792 thousand hectares. Comparing this to the 636 thousand hectares of sowing over the same period last year, there has been a impressive gain of 25%.

Maharashtra, with its 338 thousand hectares of sown land, comes in second among the states. However, when compared to the 388 thousand hectares over the same period last year, this statistic shows a loss of 13%.

404 Page Not Found

Oops! It looks like you've taken a wrong turn.

The page you were looking for might have been moved, deleted, or it could be temporarily unavailable. Please double-check the URL for any typos or try navigating back to the homepage.

In the meantime, here are a few suggestions:

- Homepage: Head back to our homepage and explore from there.

- Contact Us: If you believe this is an error or need further assistance, feel free to contact us.

We apologize for any inconvenience. Technology can be tricky sometimes, but we're here to help you find your way. Thank you for your patience!