According to the AMIS May Month report, conditions are favourable for wheat, maize, and rice, while mixed for soybeans.

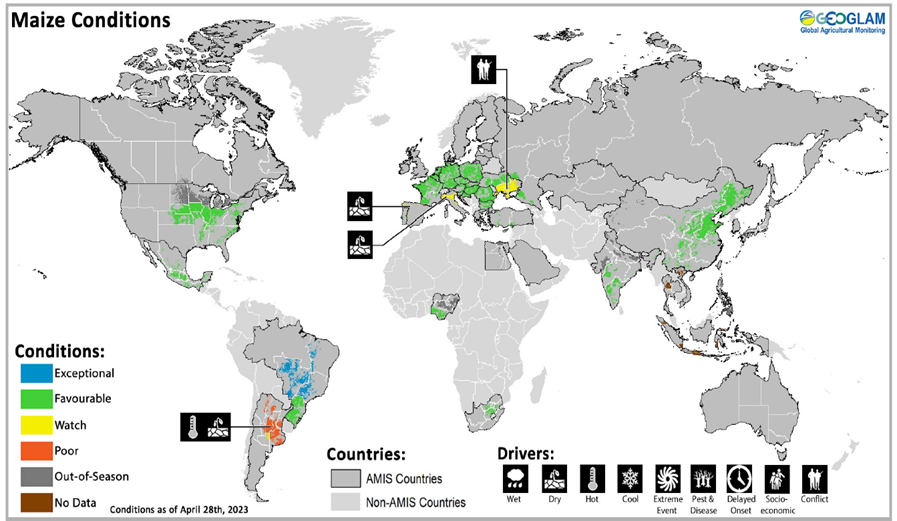

- Maize is harvesting in the southern hemisphere as sowing picks up speed in the Northern Hemisphere.

- In the southern hemisphere, harvest is wrapping up in Brazil for the spring-planted crop (smaller season) under exceptional conditions. In Argentina, harvesting continues on a poor crop. In the northern hemisphere, sowing is beginning under generally favourable conditions.

- In Brazil, harvesting for the spring-planted crop (smaller season) is progressing with primarily exceptional conditions. The summer-planted crop (larger season) is currently in the vegetative to reproductive stages under favourable conditions.

- In Argentina, harvest is ongoing with significantly reduced yields for both the early-planted crop (typically larger season) and the late-planted crop (typically smaller season), albeit at a slower pace than last year due to a higher proportion of the late-planted crop.

- In India, harvesting of the Rabi crop is wrapping up under favourable conditions. In China, conditions are favourable for the spring-planted crop.

- In South Africa, recent dry conditions are supporting crop ripening and harvesting.

- In Mexico, harvesting of the Autumn-Winter crop (smaller season) is ongoing under favourable conditions.

- In the US, sowing is picking up speed and expanding northwards into the central Corn Belt under favourable conditions.

- In the EU, sowing is ongoing under generally favourable conditions, except for drought issues in Spain and northern Italy.

- In Ukraine, sowing is beginning under favourable conditions away from the war zones.

- In the Russian Federation, sowing is beginning under favourable conditions.

World supply-demand outlook

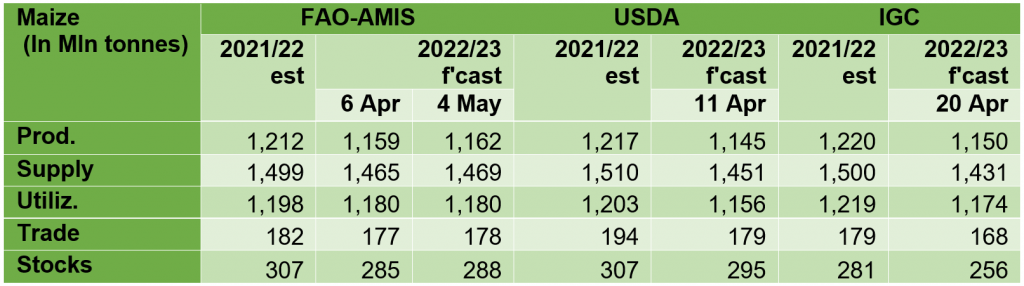

- Maize production still well below (4.2 percent) last season’s level despite a marginal upward revision this month stemming from a higher estimate for India.

- Utilization 2022/23 forecast unchanged and still set to decline by 1.5 percent below 2021/22 as a result of falls in both feed use, especially in the US and the EU, as well as industrial use, mostly in China and the US.

- Trade in 2022/23 (July/June) lifted m/m, driven by continued robust demand by the EU and higher than anticipated exports by Ukraine. Nonetheless, global trade is still seen contracting by 2.2 percent from 2021/22.

- Stocks (ending in 2023) revised up m/m reflecting higher inventories in the Republic of Korea following historical balance revisions, India as a result of higher production, and the EU owing to higher imports.

International prices

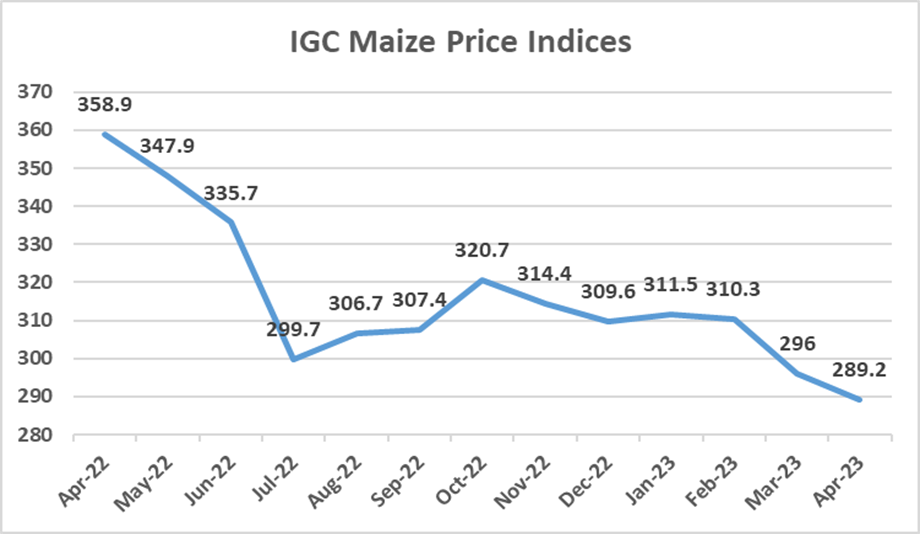

World maize export prices mostly softened in April, with the IGC sub-Index averaging 2 percent lower, marking a third consecutive monthly decline. Despite an expected sharp drop in production, quotations worked lower in Argentina, pressured by a seasonal supply boost and overall slack overseas demand.

The downside in Brazilian fob values was mainly tied to expectations for a larger surplus, but with nearby offers thinly quoted ahead of the second (safrinha) harvest. Deep sea prices in Ukraine also dropped, but were assessed as highly nominal given uncertainties about future export flows. In contrast, US values strengthened, bolstered mainly by confirmation of a series of large sales to China.

Futures prices

Grain prices displayed a downward trend in April, maize hitting an 8-month low. In the case of maize and soybeans, declines are mainly due to improving weather in the US and good planting progress, with the brisk pace of exports from Brazil providing additional downward pressure. The maize and soybean futures markets experienced a sudden dip in prices at the end of April as China cancelled large imports from the US, reversing the country’s brisk demand displayed at the end of March.

Policy Developments

In response to a severe drought that affected production, on 8 March, the Ministry of Agriculture in Argentina through resolution 78/2023, allowed maize exporters to reschedule their exports for a period of up to 180 days. This measure aims to alleviate the pressure on the domestic market and give local buyers an opportunity to purchase maize without exporters acquiring large quantities during times of limited supply.

On 13 April, Egypt announced the addition of yellow maize to the Egyptian Stock Exchange for Commodities, in a bid to improve the possibility for domestic poultry producers to purchase feed at affordable prices.

On 20 March, the Ministry of Health, Labour, and Welfare together with the Ministry of Agriculture, Forestry, and Fisheries in Japan added a waxy maize product to their list of genome-edited products not subject to regulations for genetically engineered food, feed, and biodiversity. This variety has a 100 to 0 proportion of amylopectin to pectin, compared to a proportion of 75 to 25 for conventional maize.

Source: AMIS : The above is an extract from the AMIS May 2023 market monitor published this week. It covers international markets for wheat, maize, rice and soybeans. This extract relates to Maize only. To read the complete edition click here.